Best and Worst UK Banks Revealed

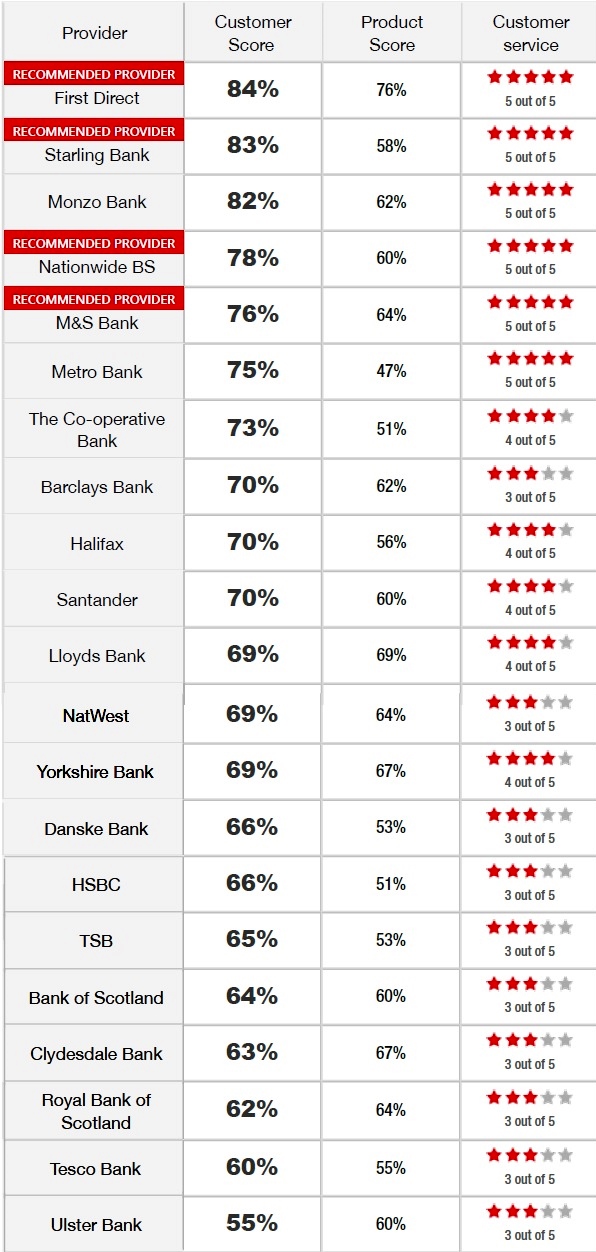

A survey carried by an independent news surveyor which was based on 4,216 members of the general public in September 2019 reveals the best and worst UK banks in 2019 leading to 2020. The table below shows the indicative scores generated by the poll and survey.

First Direct appears as the winner and a recommended provider for every one of our past eleven surveys carried by the same agency. First Direct has taken the number one slot with a customer score of 84%. It also has the highest product score at 76%. First Direct has five-star ratings across six of the ten banking services including customer service, telephone, online and mobile banking, communication and transparency of charges. It doesn’t have a branch network - so it doesn’t have a rating for this - but customers can use the branches of HSBC to pay in cash and cheques and withdraw cash at the counter. For a cheap arranged overdraft, the 1st Account is the best which is interest-free up to £250 then 15.9% EAR. To borrow £500 for one week, First Direct would charge 71p, while other banks would charge as much as much as £7.74. First Direct shares deposit protection with HSBC up to £85,000 across the two brands.

Starling Bank Coming in a close second place - with a score of 83% - Starling Bank, appearing for the first time due to a consistent increased number of customers. It meets all recommended provider criteria offering a cheap overdraft facility, in-credit interest and an above-average product score. The five-star rated Starling app offers a wide range of services including instant notifications to help spot fraud and a wide range of controls that allow instantly freeze a card for use online, in shops and for gambling transactions. The debit card is fee-free for purchases and foreign ATM withdrawals anywhere in the world, making it the perfect debit card to take on holiday. It also pays 0.5% AER on balances up to £2,000, and 0.25% thereafter, on a maximum balance of £85,000. The account must be operated entirely via smartphone banking app, though Starling customers can use the Post Office to deposit and withdraw money. Starling and Monzo were the only two banks to receive five stars for their application processes.

Nationwide Building Society has been a current account recommended provider for five surveys on the row. This year, nearly every aspect of its service was rated four or five stars by customers (they gave its mobile banking app and overall customer service the highest rating). It is one of only two providers given a four-star rating for in-branch banking services, alongside Metro Bank. No banks received five stars for in-branch banking services. It’s also publicly committed to keeping its branches open, unlike many of the biggest high-street names. Customers gave it an average of three stars for benefits, although its popular FlexDirect account does pay credit interest on balances up to £2,500 - at a rate of 5% in year one, then 1%. It also offers a top-scoring packaged account called FlexPlus.

M&S Bank for the fourth time in a row, with a customer score of 76%. The supermarket bank earned five stars for many other areas of its service: online banking; transparency of charges; communication and overall customer service. Its worst-rating is three stars for branch service. Most M&S Bank branches are open whenever the stores are open, including evenings and weekends but there are only 29 stores with branches across the UK. Last year, it achieved a depressing two-star rating for its mobile banking app. Although M&S Bank is owned by HSBC, it operates under its own banking licence which means customers are entitled to full deposit protection up to £85,000.

The worst banks for customer satisfaction namely Royal Bank of Scotland (RBS) and its subsidiary Ulster Bank. HSBC has had a below average customer score since 2013 while Tesco Bank appears to have lost the confidence of its customers, having dropped from top six to second from bottom in the table. TSB has also bounced back, after being named the worst bank for customer in 2018, when its faulty IT migration left nearly two million people locked out of their accounts. However, customers are still unhappy with the way it handles complaints (two stars) and it only achieved an average three stars for every other aspect of its service. Ulster Bank and Royal Bank of Scotland (RBS) consistently poor Ulster Bank, which operates in Ireland and Northern Ireland, has found itself at the very bottom of the table with a customer score of just 55%. Along with Royal Bank of Scotland (RBS), part of the same banking group, customers gave it two stars for complaints-handling and branch banking service. RBS customers have been hit hardest by branch closures, with 74% of branches wiped off the network between January 2015 and August 2019. With no interest, cashback or other rewards, Ulster Bank also received a lowly one star for benefits. Tesco Bank’s customer score has been poor since 2018 and it finds itself second from bottom in the table, having featured in the top six previously. A two star rating for account benefits suggests that customers are disappointed that the supermarket giant no longer pays 3% on balances up to £3,000 - existing customers saw the rate drop to 1% in June 2019. But it also earned an average three stars for: overall customer service; telephone banking; and branch banking.

Comments

Post a Comment